How Does Dental Insurance Work, Glendale AZ

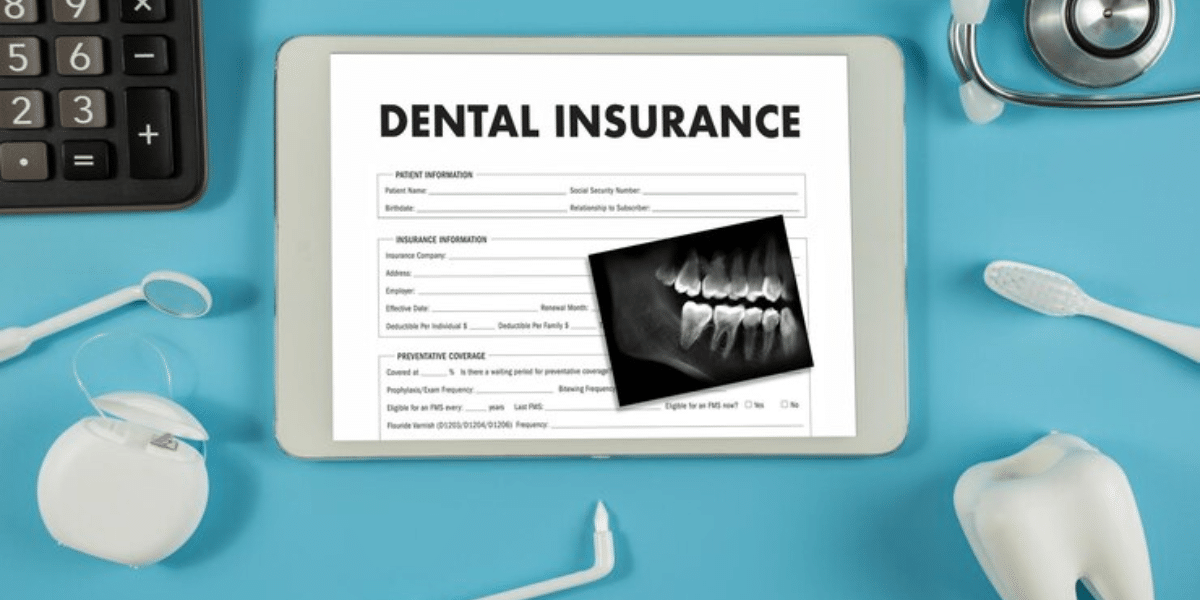

If you are in the market for dental insurance, you may be curious about how it works. Dental insurance plans come straightforward, and you can make an informed decision when selecting the right plan for your dental needs.

When you enroll in a dental plan, you enter into an agreement. Individuals who purchase a dental must pay monthly insurance premiums, along with any additional copays and deductibles that may be a part of their particular plan. The insurance company will pay your dentist for services covered at an agreed-upon reimbursement level.

To determine whether or not Singh Smile Care - Dentist Glendale, AZ accepts your dental insurance, call us at (623) 400-6009 to learn more. We are proud to serve patients in Glendale AZ and the surrounding area.

Shopping for Dental Insurance

When choosing dental insurance, many people want the insurance plan to include their current dentist. Most providers have websites with a directory of dentists within their network.

One can visit their dental insurance carrier’s website to search for their dentist’s in-network status. If their dentist is not within the network, patients can shop around for a different dental insurance provider. Alternatively, they can select a dentist in-network that accepts their insurance.

When choosing dental insurance, many people want the insurance plan to include their current dentist.

Coverage for Dental Procedures: Types of Coverage Available

Plenty of options exist for dental insurance. This can be good, as plans cater to a wide range of needs. The types of coverage, premiums, and deductibles can vary — which can be confusing.

Consider the following when choosing dental insurance:

Find Out What Plans are Available in Your Area.

Look for a Plan that Has Many Dentists and Dental Practices.

Whether one currently has a preferred dentist or not, it is essential to consider having more than one option. An insurance company that covers many dentists and providers typically remains in good financial standing with a solid reputation — meaning that claims will likely be reimbursed on time.

Consider All Costs.

When searching for a dental insurance provider, patients should first consider the monthly premium and deductible. They should also consider the amount they will have to pay out-of-pocket for dental services (copays) before insurance kicks in.

The maximum annual limit is also essential to note. Most insurance companies put a cap on the amount they will reimburse each year. Once this cap has been reached, all the patient's dental expenses will be out-of-pocket. Patients should pay particular attention if they have extensive dental issues that need to be addressed.

Most routine dental treatments remain covered under dental insurance, but many plans do not cover "extras," such as whitening or sealants. Check with the insurance carrier to learn about covered procedures. Also, be aware that some insurance plans have required waiting periods — leaving patients waiting a long time for coverage on specific procedures — especially the more expensive ones.

Plenty of options exist for dental insurance. This can be good, as plans cater to a wide range of needs.

Purchasing Dental Insurance

Purchasing dental is a personal issue and depends on how much dental work the patient needs and how many family members they have. Generally, the more dental work required and the more family members, the more value for the month.

The typical dental insurance plan covers preventive care: checkups and cleanings at 100% (no deductible), basic procedures (e.g., fillings and extractions) at 70%, and major procedures (e.g., crowns, bridges, and root canals) at 50%. Some procedures may be considered basic by one carrier and major by another, so patients must speak with their insurance carrier before getting dental treatments to understand the breakdown of costs and coverage.

Like health insurance plans, dental plans typically have a deductible — the amount one has to pay out of pocket each year before the plan starts to cover its portion of costs. Most plans cap the total amount they will pay for care per plan member per year. Any dental expenses over the plan’s cap (or maximum) become the patient’s responsibility.

Purchasing dental is a personal issue and depends on how much dental work the patient needs and how many family members they have.

Family & Individual Dental Insurance

Oral health coverage does not come as "one size fits all." Some may need insurance only for themselves, whereas others may be in the market for insurance for the entire family.

Patients can purchase individual dental insurance plans through the marketplace (U.S. government) when selecting their health insurance coverage or directly purchased through the carrier. Premiums for individual plans tend to be lower than family plans as only one individual is covered.

Family dental insurance plans cover the entire family and typically have higher premiums as more people seek coverage. Most family plans have allowances for two exams annually per plan member. Patients should find the right blend of insurance coverage that matches the entire family’s oral care needs while still being affordable.

Oral health coverage does not come as ‘one size fits all.’ Some may need insurance only for themselves, whereas others may be in the market for insurance for the entire family.

Questions Answered on This Page

Q. How can I know if my dentist accepts my insurance?

Q. What should I look for when choosing dental insurance?

Q. Is dental insurance worth it?

Q. What is the difference between family and individual dental insurance?

People Also Ask

Q. What factors should people consider when choosing a dental insurance plan?

What to Consider When Purchasing Dental Insurance

With so many options available, it can be difficult for patients to know which dental insurance plan fits their needs best. In many cases, the plan offered by their employer or professional association represents the best fit.

It may be helpful for patients to talk to their dentist to see what plans their office recommends and accepts. If patients do not currently have a dentist, they will want to look for a plan that provides the coverage they need at an affordable price. If they know they need major dental work, they should look for a policy with a high spending cap. If they have minimal dental needs, selecting a partial coverage plan may be the most fiscally responsible decision.

It may be helpful for patients to talk to their dentist to see what plans their office recommends and accepts.